Lombardi: Dr. Copper Is Saying That a Global Recession Could Be Ahead

Article by Moe Zulfiqar on Lombardi Letter

A global recession could be brewing. Investors beware: your portfolios could be on the line.

This may sound too dire, but there are warnings that a worldwide recession could become reality much sooner than expected.

One indicator of global economic health worth watching is copper prices. Due to the red metal’s relationship to the economy at large, it is sometimes called “Dr. Copper,” and there’s a really good reason behind that.

The red metal has massive industrial and commercial uses around the world. So, if something happens in the copper market, it could be taken as a warning sign that something big could be ahead for the global economy.

With this said, copper prices have been tumbling, and this trend could be saying that the economy is in trouble.

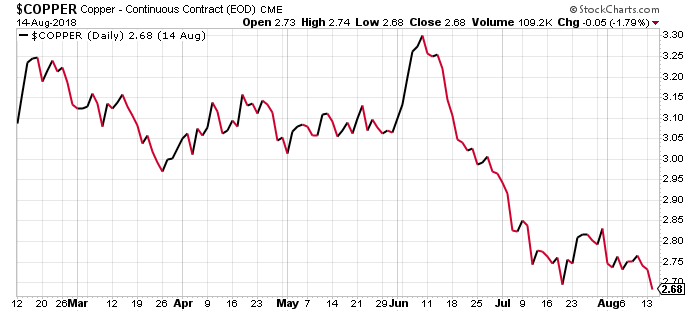

Look at the copper price chart below to get some perspective.

In early June, copper was trading at around $3.30 per pound. Now it trades at $2.68. This was a decline of close to 19% in matter of a few months.

This is one of the fastest declines we have seen in copper prices in a while, and it shouldn’t be taken lightly.

Here’s the thing: if you look from a technical analysis perspective, it appears that the price of copper could drop further. We see the red metal’s price breaking below a key support level, momentum indicators turning in favor of buyers, and trading volume increasing as prices drop.

From a fundamental analysis perspective, we are seeing the amount of copper stored in warehouses increase. There has been a solid uptick in inventory levels since early August. When copper keeps piling up in warehouses, it means there’s less demand for it.

This is all very bearish for copper, and ultimately a sign that a global recession could be looming.

Why Worry About a Global Recession?

Over the past few years, the global economy has worked really hard to fight slow growth.

When I say “the global economy,” I mean collectively central banks around the world. They have lowered their interest rates and printed money to make sure economic growth remains intact.

Despite all that, we haven’t seen robust growth. Take the eurozone, for example; it’s still growing at a dismal pace. The European Central Bank (ECB) has been printing money and keeping interest rates low. Its efforts have been relatively failing so far.

If copper prices are correct and we are headed toward a world recession, I see a big mess this time around.

In the previous global recession, central banks had some room to maneuver. Now, if there’s another big recession, central banks may not be able to do much.

In the midst of all this, investors could get hurt badly.

Remember, earnings matter a lot. A global recession could take a very heavy toll on companies’ revenues and earnings. Obviously, their stock prices would react to this situation by falling.

With all this in mind, be very careful when it comes to making investment decisions.

To read this article on Lombardi Letter, click here