FX Empire: Gold Rises as Iraq Falls

Source: FX Empire

Author: Barry Norman

Gold might have seen a bit of a rally this week, fueled by Federal Reserve Chairwoman Janet Yellen’s comments that interest rates will stay low and tapering will continue into July. But even this brief moment of strength, which saw gold rally to a near 13-week high of $1,322 per ounce, doesn’t paint an accurate picture of the yellow metal.

The violence in Iraq has been the main focus of the markets and the headlines over the past weeks. The possibility of the fighting moving on to neighboring countries such as Syria and Jordan remain a distinct possibility. Most traders are discussing the implications daily as asset prices swing radically as the situation continues to destabilize the government.

In a recent conversation with fellow professional, Scott Carter, CEO of Lear Capital, the discussion moved to the effects of the Iraq instability and its effect on precious metals. After our discussion, I asked Scott to put his views in writing. I received the below article yesterday and am eager to share it with my readers.

________

Gold Rises as Iraq Falls

With the crisis in Iraq dominating the headlines almost every day this month, gold has been brandishing its safe-haven status. The dollar, on the other hand, has been hit with its longest downturn in almost two months.

In a matter of weeks, the world has been introduced to a murderous, new militant group deemed worse than Al-Qaeda that has marched through Iraq with chilling precision. News images portray fleeing Iraqi soldiers, mass executions, and triumphant truck bed gunners advancing virtually unopposed through key Iraqi provinces.

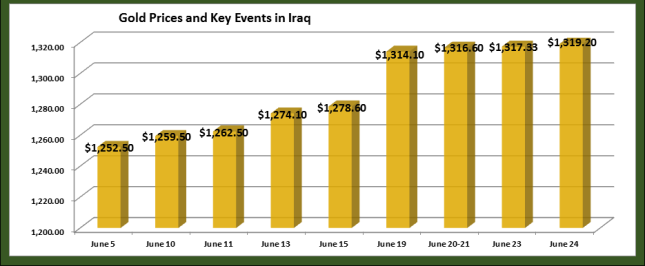

ISIS or the Islamic State in Iraq and Syria has suddenly become a formidable jihadist force as colonial cities have been toppled like dominoes … Samaraa on June 5th, Mosul on June 10th, Tikrit on June 11th, Tal Afar on June 15th, Al-Qaim on June 20th.

ISIS or the Islamic State in Iraq and Syria has suddenly become a formidable jihadist force as colonial cities have been toppled like dominoes … Samaraa on June 5th, Mosul on June 10th, Tikrit on June 11th, Tal Afar on June 15th, Al-Qaim on June 20th.

As ISIS has subjugated hundreds of miles of territory and much of Iraq’s Western border, the price of gold has risen in lock-step with their advance. Since ISIS forces attacked Samarra back on June 5th, gold is up almost 5 1/2 %. It jumped over 2% with the capture of Tal Afar, its airport, and the purported execution of several hundred Iraqi soldiers.

It surged another 2% days later with the taking of Saddam Hussein’s chemical weapons facility at Al Muthanna. With the most recent fall of the Baiji refinery, gold has jumped again.

ISIS, sometimes referred to as ISIL: the Islamic State of Iraq and Levant which includes the Eastern Mediterranean regions of Cyprus, Palestine, Jordan, Syria, and southern Turkey … is seeking to establish a “caliphate” or a traditional Islamic state and one that unites all Muslims under its rule.

So why is this fueling gold price?

For three, basic reasons:

1) The advance of ISIS further agitates Iraq’s sectarian challenges. ISIS represents the Sunni majority in Iraq who are currently controlled by the Shiite-dominated government in Baghdad which has been criticized for its divisiveness. The oil-loving and autonomous Kurds of northern Iraq also have strained relations with Baghdad adding factional fuel to an already divided country. If fighting spreads into the Kurdistan region, the fiercely independent Kurds could be drawn into the conflict, potentially triggering an all-out Civil War.

2) The spreading clashes threaten key Western allies. The advance of ISIS near the Jordan-Iraqi border continues to worry Jordanian officials who fear an incursion of Islamic extremists and terror cells into their constitutional monarchy. Israel is also watching developments in Iraq with keen attention and deep concern as ISIS expands its conquests amid saber-rattling about liberating Palestine and accessing and deploying nuclear weapons.

3) Unrest in Iraq could threaten supplies of crude oil. Iraq is OPEC’s second largest oil producer and constitutes as much as 40% of global supply. An interruption or decrease in Iraqi oil exports could spike prices and ultimately threaten the world economy particular the tenuous recoveries in Europe which could quickly teeter back into recession.

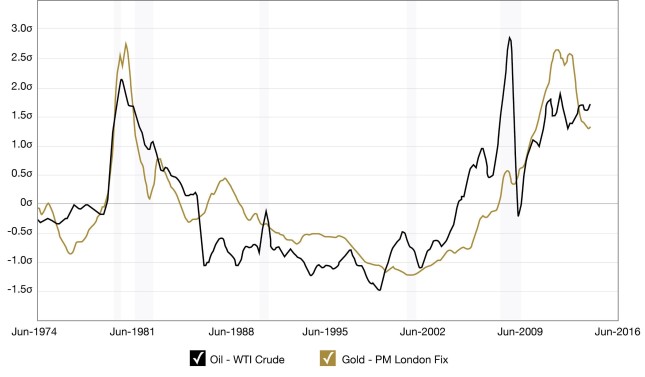

The oil to gold correlation is an important one. They are, in many respects, cousin commodities tied to common economic conditions like inflation, the value of the dollar, and interest rates. Crude oil is perhaps the world’s most strategic commodity while gold is among the most coveted.

Rising oil prices places direct stress on the engine of the global economy by impacting gasoline, shipping, manufacturing, travel and transport, and the overall cost of doing business. This influences gold in a positive way since it is a “safe haven” asset that helps to offset financial risk.

In terms of price, oil and gold tend to rise and fall in unison. Historically, when oil prices have moved higher, gold has followed. Who can forget the Oil price shock of the 1970’s, the ensuing recession, and gold’s legendary run? From 1973 to 1974, oil prices quadrupled as gold prices closely followed suit rising an astonishing 72.5%.

The chart below illustrates the strength of this correlation for the past 40 years.

So as ISIS continues to roll across Iraq vanquishing towns, cities, border crossings and refineries … it has also seized stockpiles of weapons, tanks, US helicopters, Humvees, munitions and money to further fuel its unrelenting advance. How far will they go? Where will it end?

It is this uncertainty that fuels gold and the situation in Iraq is a hot-bed of “what-if’s” … What if Iraq’s 3.3 million barrels of daily oil production is disrupted? What if Baghdad falls? What if America is drawn in? What if Iraq disintegrates? What if Israel reacts?

ISIS is very clear about their intentions to create a hardline Islamic State and their expansionist aspirations may go well beyond Syria and Iraq and extend as far as North Africa and South East Asia.

In gold’s world view, however, this conflict is just one crisis. When we add unrest in Ukraine and Syria, Asian demand, global currency wars, the devalued dollar, rising inflation, and US debt many of the key accelerants of uncertainty and unpredictability are present to keep gold well-positioned as a time-honored safe haven and a global store of value for months, if not years, to come.

__________________________________

Scott Carter – Chief Executive Officer

With a background in commercial insurance, financial services and retail precious metal sales, Scott Carter is uniquely qualified to address the benefits of holding physical financial assets. Carter is a leading advocate for acquiring gold and silver as a hedge against collapsing currencies, soaring global debt, and political and economic tensions around the world.

With an MBA from Lake Forest Graduate School of Management and executive tenures at Goldline International and Allstate Insurance, Mr. Carter is an economic theorist, an investment specialist, and an authority on precious metals. Carter is also a popular talk show guest with appearances on Bloomberg Businessweek, CBS Market Watch, Fox Business News, The National Post, Forbes, and Investors.com.