The Dreaded D's: Deflation, Depression and the Dollar - Part 1

Source: FX Empire

Author: Barry Norman & Scott Carter

As global traders, economists and analysts hold tight at their desks waiting for the ECB decision today, many market players are taking a serious look at the effects of monetary policy over the long term, now that the financial crisis is behind. My associate Scott Carter from Lear Capital shared a lot of his insights with me and I wanted to share them with my readers. Together Scott and I put together this informational 2 part article on the effects of the recent financial crisis and monetary policy and what we can expect the future to hold.

In the wake of some of the largest economic stimulus measures in history, Fed Chair Janet Yellen has been in no hurry to normalize the government’s accommodative monetary policy. Yellen has long been considered an inflation dove and has consistently reinforced her embrace of a gradual QE taper and a desire to maintain ultra-low interest rates. She has repeatedly asserted that the recovery is not complete and points to continued slack in the labor market, flat wage growth, and a historically low Labor Participation Rate.The irony of all of the Fed’s monetary accommodation is the behavior of inflation. It has remained astonishingly low. Inflation is a double edge sword and for federal policymakers, it is also a balancing act. When we have too much inflation, we experience higher prices and lower buying power. When we have too little inflation, we are subject to a lower demand for goods and falling profits.

While Yellen has not turned a Yeatsian “blind eye” to inflation, her benchmark rate of 2% or more has not been an easy level to maintain. Since taking office on February 3rd, US inflation has been below 2% three times.

Ultra low inflation of this nature can impact the value of homes, stocks and pay checks. If the price of goods and services tumbles too rapidly, consumer spending often pulls back as buyers postpone major purchases, waiting for a “price bottom.” This triggers a deflationary cycle. Since cash and spending are the main fuel of the economy, when money is sidelined and cash is hoarded, it can dramatically slow the economic engine of the country.

Ultra low inflation of this nature can impact the value of homes, stocks and pay checks. If the price of goods and services tumbles too rapidly, consumer spending often pulls back as buyers postpone major purchases, waiting for a “price bottom.” This triggers a deflationary cycle. Since cash and spending are the main fuel of the economy, when money is sidelined and cash is hoarded, it can dramatically slow the economic engine of the country.

Deflation is inflation’s alter-ego. It constitutes a dramatic drop in prices often resulting in decreased money supply and/or a lack of available credit. While inflation reduces the value of money and can impact those on fixed incomes, the damage of deflation is more broad based and results in a lower demand for goods, slashed productivity, decreased output, and an increase in pessimism.

While there are many tools for fighting inflation … deflation is more difficult to combat. It can impact investment, corporate profits, new hires, wages, and result in an overall reduction in the work force. At extreme levels, deflation can trigger a recession and even an economic depression which undermines the value, strength, and solvency of the dollar.

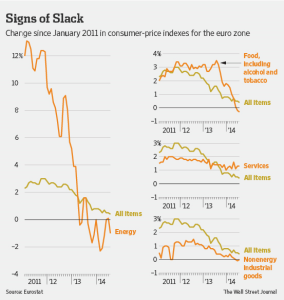

One of the key deflationary concerns for the current global economy is Europe’s dangerously low inflation rate. The inflation rate for the 18 countries that use the euro fell to an astonishing .3 percent in August, a five-year low and well under the 2% benchmark. Inflation for the Eurozone has been below 1% since October of last year.

The dip in European inflation has been fueled by steadily declining energy, food, alcohol and tobacco prices which have brought the inflation rate to deflationary levels. This has made it difficult for the European economy to turn around as the demand for goods has decreased and corporate profits have stumbled. In addition unemployment which peaked at 12% last year has made only marginal progress this year, improving by just half a percent to 11.5%. Unemployment is in double digits in France, Ireland, Italy, Slovakia, Portugal and Cypress while more than 50% of workers under the age of 25 in Greece and Spain remain jobless.

Part 2 will be published on Friday morning. Keep an eye out for additional articles by Barry Norman and Scott Carter