Once Upon a Stimulus: The Global QE Story

It’s no secret that the US dollar has lost value. We’ve all seen the numbers which cite a drop in purchasing power of as much as 98% since the creation of the Federal Reserve. For over 100 years, the dollar has been steadily degraded by debt, deficits, stimulus, and money tampering by the Fed.

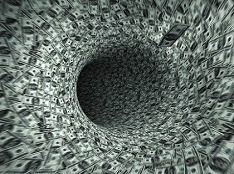

There is perhaps no greater manipulation of a given economy than the process of printing money. Excess money creation triggers rapid devaluation. It masks real growth, generates inflationary conditions, and can ultimately lead to damaging hyperinflation. Perhaps the most dangerous consequence of all however … is that it can perpetuate a deceptive narrative.

Let’s face it, having a lot of money floating around feels pretty good. So good in fact, that the story of our economic healing has assumed mythic proportions. America’s pro-stimulus policies are being credited with driving stocks to new heights, pushing unemployment to new lows, and boosting GDP growth well past estimates.

America’s “fairytale recovery” has been so convincingly portrayed that the entire world has started to believe in the prevailing wisdom of QE. The Japanese have been at near zero interest rates for quite some time. The ECB is set to unleash a €1.5 trillion printing spree to combat deflation, which is not only unprecedented but far larger than expected. Economically troubled Greece has just firmly rejected austerity with the election of Alexis Tsipras who will likely open the flood gates of government stimulus. India’s central bank has also just cut its official interest rate by 0.25%. The Chinese are now discussing new targeted easing measures. And then there are the venerable Swiss who recently stunned global markets by lowering their interest rate to an unparalleled -0.75%.

This now puts the US in the unusual position of trying to tighten its belt while all the world is systematically loosening theirs in an all-out war on deflation. The ultimate irony is that experts now cite deflation as one of the many unavoidable by-products of QE.

So the realists among us look beyond the happy headlines to deeper and more revealing indicators … while stocks have hit new highs, the markets have grown increasing dependent on Federal incentives. US unemployment is down but so is Labor Participation. America’s GDP is up but wages are stagnant. Gas prices have fallen but the global economy has started to collapse all around us.

The universal economic malaise could not be more palpable and the question remains as to whether a multi-national, multi-cultural, multi-currency spending spree can indeed fix the world. While a massive injection of cash often looks good “on paper” … an avalanche of new currency effectively buries productivity and real growth.

So as central banks continue buy into the QE storyline and settle their debts with newly printed money, global currencies will become increasingly weaker. As a matter of fact, no fiat currency in history has ever maintained its value in the wake of mass money printing, and only one form of money has been the direct beneficiary of the resulting transfer of wealth. So whether you’re holding dollars, euros, yen, or francs … now is a critical time to diversify a portion of your savings and retirement into the strongest currency in the world … solid gold.