When Should You Buy an Umbrella?

Have you ever planned a trip to an amusement park only to have it rain cats and dogs on all your fun? Ever notice what the vendors do when that happens? Do they pack up all their ice cream and sunscreen and call it a day? Of course not! Seizing the occasion creates a new money making opportunity!

Away goes the cotton candy and sunglasses and out comes the rain ponchos and the umbrellas – at a STEEP markup that wet tourists are more than happy to pay.

Perhaps those tourists didn’t pay attention to the weather forecast, or they didn’t take it seriously. Perhaps just dumb optimism. And those $15 ponchos sell out quickly, don’t they?

When should you buy an umbrella or a rain poncho?

Related question: When should you buy gold or silver?

The Amusement Park Poncho Analogy

Wall Street isn’t too different from this amusement park scenario. The financial forecast is there for everyone to see, but optimism is winning the narrative. The real issues aren’t being taken seriously enough.

We know the debt is unsustainable. We know the dollar has already been printed into oblivion. This bull stock market is very long-in-the-tooth. Government spending is out of control and they just cut taxes – which is great, but only exacerbates our budget problems. Foreign appetite for our debt is falling. Trade wars are looming. It’s just a matter of time before a domino falls.

Protection and insurance measures like owning gold and silver are so obvious and cheap right now. Anyone can get their hands on them, but only a few savvy planners do. The rest will be left out in the rain, paying high prices for wealth preservation measures after the next crisis hits.

That will be tomorrow’s terrible price of today’s cock-eyed optimism. And most people will be forced to pay it.

This, from Timothy F. Devlin in The Spokesman opinion section, April 28:

“Our national debt is careening out of control and the picture worsens each day. Washington seems to be burying their head in the sand. The annual budget deficit is expected to top $1 trillion in 2020, bringing our cumulative national debt to over $33 trillion by 2028. To put this in perspective, the debt is greater than what the U.S. produces in a whole year. This high debt-to-GDP ratio tells investors we may have trouble repaying the loans. That’s a new and worrying occurrence for the United States. In 1998, the debt was only half of America’s economic output...

“By 2023, according to the budget office, interest costs are projected to exceed what the government spends on the military. By 2028, interest payments will reach $915 billion, more than triple the interest costs last year. Imagine if interest rates continue to rise as creditors demand a higher return for higher risk debt. Can you imagine the day that U.S. debt is rated as speculative?” [emphasis added]

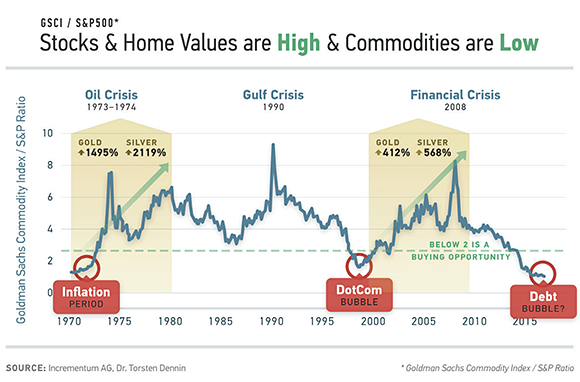

The below chart sums up the gathering clouds and your opportunities for protection. This tracks the commodities index through booms and busts, showing you the massive increases gold and silver have experienced during our crisis years.

Folks, gold and silver are firmly in buying territory right now…

But the storms are coming.

When should you buy an umbrella or a rain poncho? When the sun is shining and no one else is thinking about it, that’s when.

And that’s also when you buy your gold.