Inflation: The Silent Wealth Killer

Hardly a day goes by without inflation being a topic of conversation in the news media, on economic forums, and in political blogs. Every month, the Federal Reserve — whose goal is to maintain the stability of the world’s largest economy — creates monetary policies that affect every day Americans, foreign countries, and everything in between.

One of the Fed’s top priorities is keeping inflation under control. But what exactly is inflation? According to Wikipedia:

Inflation [in-fley-shuh n] noun 1. Economics. A persistent, substantial rise in the general level of prices related to an increase in the volume of money and resulting in the loss of value of currency.

In layman’s terms, inflation occurs when you have too many dollars chasing too few goods, which results in higher prices for the same products. It doesn’t matter if it’s cars, apples, toilet paper, cell phones, or the cost of higher education. When inflation grows, your money doesn’t buy as much and your purchasing power is reduced. This is especially burdensome to individuals on fixed incomes, like senior citizens who collect social security or retirees with fixed pensions.

How is inflation measured?

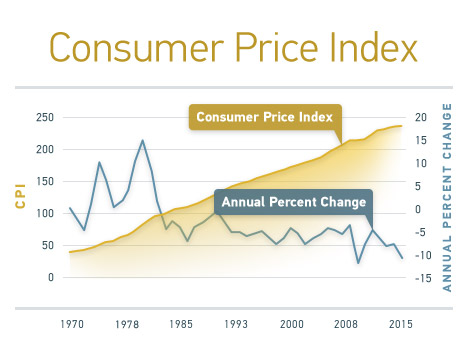

The most recognized measurement is the Consumer Price Index (CPI), which is the basis for Social Security adjustments and government pension cost-of-living increases. Each month, the Bureau of Labor Statistics (BLS) publishes the results of its price survey. It aggregates and weighs price data for the following major categories: food and beverage, housing, apparel, transportation, medical care, recreation, education, communication (telephone), and other goods/services such as tobacco and hair care.

These buckets of goods and services make up the CPI and are used to measure changes in price over time.

Perceived inflation vs. real inflation.

Have you noticed that a bag of pistachios at Costco now costs $22 when it was $15 last year? What about smaller packaging? Today’s Haagen Dazs bars are half the size of the originals. And, McDonald’s Filet O Fish sandwiches have gotten so small that they look like sliders.

While the price of toilet paper may not have changed much, the number of sheets in a roll has. If you’re like most people, you probably think prices have gone up a lot more than the official published inflation rate, which is projected to be 2% in 2016.

Then what accounts for the disconnect?

Unfortunately, the algorithm they use to determine the CPI isn’t published, nor is it straightforward. And, there are many different indexes that get published and referenced. In particular, the “core” CPI, that many financial analysts follow, excludes the costs of food and energy from its analysis.

When the BLS calculates the “official” rate, they average in prices for all the categories they monitor. So if the cost of computers or cars goes down, that will offset rising food prices. The trouble is, you buy cars and computers every few years, but you buy milk and eggs every week.

So the weighting may not reflect your actual household spending habits and you could be spending more every month even when the published inflation rate is quite low.

What causes inflation?

When there’s an increase in the money supply, inflation usually accompanies it. This can happen in a couple of ways. Our banking system is built on a concept called “fractional reserves” which allows banks to take in deposits — savings, CDs, money market accounts, etc. — and then lend out more money than they actually have in these accounts. Since it’s not a dollar-for-dollar trade, additional currency is created. When there is growth and the economy is expanding, this can be a good thing because the money is often loaned to businesses and consumers whose spending sustains the growth.

The downside is that when there isn’t sufficient growth, there isn’t enough demand for the money that’s entered the system. When this happens, the value of the currency decreases, resulting in less purchasing power for everyone.

The second way the money supply gets increased is with the stroke of a pen. The Federal Reserve can simply authorize the printing of more money. In response to the financial crisis of 2008, the Fed stepped in and exponentially increased the monetary base to purchase trillions of dollars in mortgages and bonds. Although this did jump start the economy in the short term, in the long term, it increased the national debt, which was already burdened by liabilities like social security, Medicare and years of government deficit spending. The consequences of these unprecedented actions — which have been hotly debated for years — will be revealed some time in the future.

Preparing for Inflation

John Maynard Keynes, one of the most influential 20th-century economists and the founder of the International Monetary Fund (IMF) offered a powerful reminder on the impact of inflation when he said, “By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

Unfortunately, inflation often triggers a rise in interest rates as investors demand greater return and compensation for their risk. Before long, other assets like real estate and stock markets are negatively impacted, and the cycle continues downward until painful changes are necessary to reverse course and become fiscally responsible again.

But there are several prudent steps you can take to prevent inflation from jeopardizing your financial security. The first is to get educated. Stay abreast of what’s happening so you can be prepared financially and emotionally. Then develop strong ties with your family and like minded neighbors so you can help each other when the need arises. A solid network can share resources and provide psychological support in trying times.

When calculating what’s needed for retirement, not only do you need to consider how inflation will erode your purchasing power, but you need to remember that people are living much longer than they use to. These two considerations will have a significant impact when creating your financial plan and may require a delayed retirement.

The final step in protecting yourself from the ravages of inflation is diversifying your portfolio. Investing in assets like gold and silver that historically perform well when financial markets falter is a proven hedge against inflation. Coins are especially attractive because they are easy to transport, their value is recognized all over the world, and they can be used as currency in turbulent times.