Wall Street is in Denial. Are you?

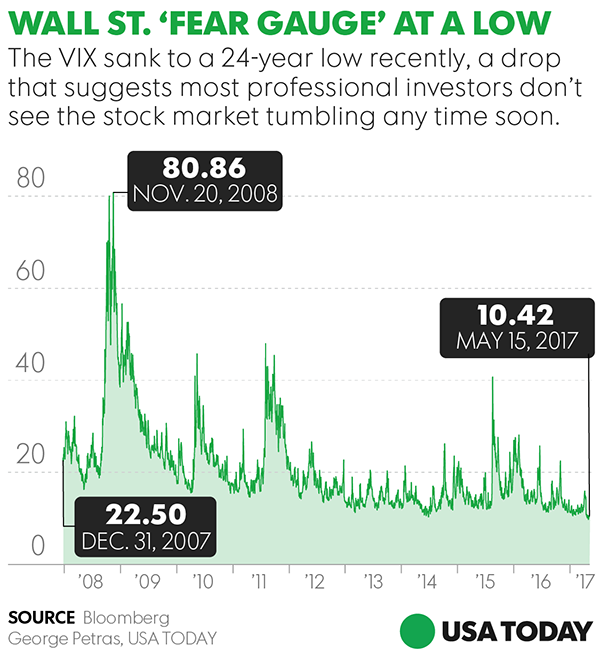

A recent article in USA Today describes the very low “fear gauge” on Wall Street, coupled with record high stock prices and concludes that today’s investor should be worried about a potential repeat of another financial crisis - precisely because Wall Street isn’t. The VIX, known as the “fear guage” hasn’t been this low for 24 years! When the VIX is low, investors get complacent and sloppy, leaving themselves at risk for unexpected fiscal slowdowns. See in this chart what the VIX did before and after the housing crash.

The VIX, known as the “fear gauge” hasn’t been this low for 24 years! When the VIX is low, investors get complacent and sloppy, leaving themselves at risk for unexpected fiscal slowdowns. See in this chart what the VIX did before and after the housing crash.

Another analysis from fund manager John Hussman goes into the psychology of main stream Wall Street just before bubbles pop. (Mind you, Hussman was one of the very few that was right about BOTH the tech bubble crash and the housing crash.) He thinks we should be bracing for an EVERYTHING crash these days.

He begins his recent commentary with a litany of quotes from the “smart” guys on Wall Street explaining as convincingly as they could why this time is different.

One of the quotes:

“Old ways of valuing stocks are outdated. A technological revolution has created opportunities for continued low inflation, expanding profits and rising productivity. Thanks to these factors, the United States may be able to enjoy an extended period of expanding stock prices. Jumping out now would leave you poorer than you might become if you have some faith.”

Another quote to give some perspective on how fast things can change:

- Los Angeles Times, May 11, 1999. While it’s tempting to counter that the S&P 500 would rise by more than 12% to its peak 10 months later,Another quote to give some perspective on how fast things can change: it’s easily forgotten that the entire gain was wiped out in the 3 weeks that followed, moving on to a 50% loss for the S&P 500 and an 83% loss for the tech-heavy Nasdaq 100..

We’re hearing the same things from Wall Street now.

Everything is Overpriced, Could Gains Since 2008 Get Wiped Out?

This seems to be the takeaway from a recent analysis from fund manager John Hussman. Before the tech bubble popped, piles of cash were bieng dumped on anyone who uttered the words "hot IPO" and before the housing bubble anyone with a pulse could get a "no doc" mortgage.

So what is overpriced these days...... According to John Hussman, EVERYTHING.

So while some will look for pockets of relative insanity to avoid, the reality is the whole market is toppy. This makes it tempting to see nothing specific egregiously out of whack compared to everything else and conclude everything is fine.

Here's a quote from history to show how stock market highs can be misleading:

"Stock prices have reached what looks like a permanently high plateau."

- disgraced former celebrity economist Irving Fisher NINE days before the 1929 crash that ushered in the Great Depression.

The fact is, your retirement security depends on you understanding reality, not fantasy. Here is the reality from USA Today:

* Stock prices are high. The S&P 500 is now trading at nearly 18 times estimated corporate earnings for the next four quarters, or more than 20% above its average long-term valuation, according to Thomson Reuters. Ramsey sounds a more alarming tone: "Valuations," he says, "are higher than at any other time other than the 24 months around the tech bubble peak in March 2000."

* Old worries aren't dead. An economic downturn in China, the world's second-largest economy, is still a risk, says Keon. Populism in Europe isn't dead either, he says, even though French voters recently rejected the nationalist presidential candidate Marine Le Pen in favor of centrist Emmanuel Macron. Geopolitical tensions around the world in places like North Korea and Russia can also reignite at any time, Keon adds.

* Political risk. "Washington remains a wild card," Terry Sandven, chief equity strategist at US Bank, has warned in a report. President Trump's political troubles tied to his firing of FBI chief James Comey and his campaign's ties to Russia could get worse, which could dent investor confidence and further delay his market-friendly economic agenda, such a promised tax cuts.

When the next downturn hits, a wave of investors will flee en masse into safe havens like gold and silver, which should increase the prices of gold and silver.

This lack of fear in the markets right now, in spite of evidence of an impending sell off, is doing you a huge favor. It is keeping gold and precious metals prices down and very reasonable. If they inch lower for a time, even better.

Your buying opportunity is NOW especially if you plan on diversifying your portfolio to hedge against the next market downturn.