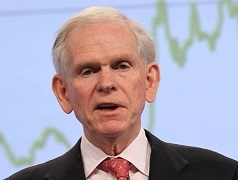

Market Watch: 'Good Luck! We'll All Need it' - U.S. Market Approaches End of 'Superbubble,' Says Jeremy Grantham

Article by Christine Idzelis in Market Watch

The U.S. is approaching the end of a “superbubble” spanning across stocks, bonds, real estate and commodities following massive stimulus during the COVID pandemic, potentially leading to the largest markdown of wealth in its history once pessimism returns to rule markets, according to legendary investor Jeremy Grantham.

“For the first time in the U.S. we have simultaneous bubbles across all major asset classes,” said Grantham, co-founder of investment firm GMO, in a paper Thursday. He estimated wealth losses could total $35 trillion in the U.S. should valuations across major asset classes return two-thirds of the way to historical norms.

“One of the main reasons I deplore super-bubbles — and resent the Fed and other financial authorities for allowing and facilitating them — is the underrecognized damage that bubbles cause as they deflate,” said Grantham.

The Federal Reserve doesn’t seem to “get” asset bubbles, said Grantham, pointing to the “ineffably massive stimulus for COVID” (some of which he said was necessary) that followed stimulus to recover from the bust of the 2006 housing bubble. “The only ‘lesson’ that the economic establishment appears to have learned from the rubble of 2009 is that we didn’t address it with enough stimulus,” he said.

Equity bubbles tend to begin to deflate from the riskiest parts of the market first — as the one that Grantham is warning about has been doing since February 2021, according to his paper. “So, good luck!” he wrote. “We’ll all need it.”

“We are in what I think of as the vampire phase of the bull market, where you throw everything you have at it,” Grantham wrote. “You stab it with COVID, you shoot it with the end of QE and the promise of higher rates, and you poison it with unexpected inflation – which has always killed P/E ratios before, but quite uniquely, not this time yet – and still the creature flies.”

That is “until, just as you’re beginning to think the thing is completely immortal, it finally, and perhaps a little anticlimactically, keels over and dies,” said Grantham. “The sooner the better for everyone.”

The Nasdaq has dropped 9.5% this month, through Thursday, exceeding the S&P 500’s nearly 6% slide and a 4.5% loss for the Dow, according to FactSet data.

As for GMO’s investment recommendations, Grantham summarized them as avoiding U.S. equities while emphasizing value stocks in emerging markets and cheaper developed countries, “most notably Japan.” On a personal note, he said, “I also like some cash for flexibility, some resources for inflation protection, as well as a little gold and silver.”

Beyond the recent record highs of the U.S. stock market and “crazy” investor behavior that has .......

To read this article in Market Watch in its entirety, click here.