Investment Coins vs. Gold Stocks

Why Gold Stocks and Funds May Not Be the Best Play in a Gold Bull Market

Should a gold bull market arise amidst bearish stocks, as the majority of major brokerages have recently predicted, you might logically assume that everything “gold” would simply go along for the ride.

Should a gold bull market arise amidst bearish stocks, as the majority of major brokerages have recently predicted, you might logically assume that everything “gold” would simply go along for the ride.

And your logical assumption would be entirely wrong.

Gold stocks do not march in lockstep with the physical metal. The “stock market down, gold stocks up” theory is really a myth. History teaches us that much.

Victor Flores, Gold Fund Portfolio Manager at United Services in San Antonio, said in Investor's Business Daily, that “the performance of gold stocks at the end of 1987 should serve as a reminder to investors that these issues are still stocks and vulnerable like other equities during bouts of market weakness."

“Gold Stocks After 1987's Black October”

In the devastating “Black October” of 1987, for example, the Dow fell 41%, from 2746 to 1616. Meanwhile, the XAU, which is the index of gold stocks, fell 46%, from 157 to 84. However, the price of physical gold in that same time period, ran up over 18%.

What's more, gold stocks stayed down longer than the Dow. The devastated XAU index ended the following year, 1988, virtually unchanged... while the Dow had recouped nearly half of its Crash of 1987 losses by then, enroute to the greatest stock bull market in history.

In fact, over the past 26 years, the Dow declined at least 10% a total of 25 times... while over the same period gold stocks declined an even greater percentage and for a longer period of time, too.

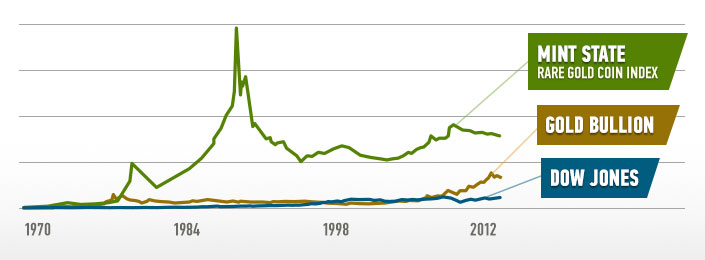

The historical track performance of premium coins reveals they can magnify whatever rally gold is enjoying. But, at least, physical bullion demonstrates a better separation—or diversification—for the Dow than gold stocks.

Wealth You Get to Hold in Your Hands

The bottom line? Should gold rally as predicted and the Dow continue its bearish ways, don't always count on gold stocks and funds to participate in the rally.

There's nothing more honest than gold in your hand. It's already out of the ground... there's nobody between you and the metal... it can't vanish through creative accounting or forward selling... and some company president can't mismanage it away.

A gold coin is yours and yours only.

Why bother playing a watered down version of physical gold, when the real thing is so investor-friendly?

Check out our Premium Coin Analyzer today!

The statements made on this Website are opinions only. Past results are no guarantee of future performance or returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same depending on a variety of factors. Lear Capital, Inc. cannot guarantee, and makes no representation, that any metals purchased will appreciate at all or appreciate sufficiently to make customers a profit. Lear is a retail seller of precious metals and its buyback (or bid) prices are lower than its sell (or ask) prices. Metals must appreciate enough to account for this difference in order for customer to make a profit when liquidating the metals. Lear does not provide financial advice or retirement planning services. The decision to purchase or sell precious metals, and which precious metals to purchase or sell, are the customer’s decision alone, and purchases and sales should be made subject to the customer’s own research, prudence and judgment.