Gold Bullion Coins - The Big Six

Gold and silver can be purchased in many forms such as bars and coins of various weights. Similar to most investments, the forces of supply and demand drive the price of gold and silver coins; the demand in this case is generated not only from investors but also from central banks, jewelry producers and industrial use.

Types of Gold Coins

When analyzing options, investors have several options. The gold bullion coin is the most well-known with the value of the coin being derived from the precious metal content. Premium coins, also referred to as premium coins can have values that often exceed their metal content because they are considered collectible and minted prior to 1933. Finally, limited minted coins have two opportunities for appreciation: upward movements in the spot price of metals as well as a premium to be commanded by their scarcity in comparison to their contemporary bullion counterparts.

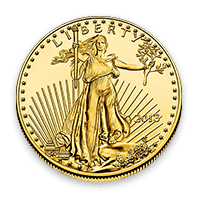

Gold American Eagles

American eagle coins, first introduced in 1986, are the most popular gold bullion coins in the United States. Due to their popularity, with around sixteen million produced since introduction, they provide gold investors with liquidity and global recognition. Each gold coin has the same design with Lady Liberty on the front and an eagle soaring above a nest on the reverse.

Gold Australian Kangaroos

The Perth Mint Kangaroo gold coins have a uniqueness not found on other gold bullion coins due to their regularly changing backs. Each coin, similar to the Canadian Maple Leaf Gold Coin is .9999 pure. The front of the Kangaroo gold coin has Queen Elizabeth II and the back changes annually.

Gold Canadian Maple Leafs

The Royal Canadian Mint’s Gold Maple Leaf coin was introduced in 1979 and is among the purest official bullion coins worldwide due to its .9999 millesimal fineness. The front of the Canadian Maple Leaf coin has Elizabeth II and the back a Maple Leaf. Due to the softness of the 24-karat gold and clear area around Elizabeth II, the coin easily shows marks, a standard problem with pure gold.

Gold Chinese Pandas

The Chinese Gold Panda Coin was first minted by the Peoples Republic of China in 1982. The Chinese Gold Panda is .999 fine gold. To meet growing international appeal of the coins, in 2016 the Peoples Republic of China began minting the Gold Pandas in metric system sizes. The back of the coin depicts the image of the Hall of Prayer for Good Harvest in the Temple of Heaven. The front of the coin depicts a Panda, which varies in depiction each year.

Gold South African Kruggerrands

The Kruggerrand, minted in South Africa, is the second most popular gold bullion coin in the United States and in Europe are more popular than the gold eagle coins. Since 1967, over 42 million have been minted; making them the most minted gold bullion coin when compared to all others. The gold Kruggerrand was the first coin ever minted for private ownership. The front of the coin bears the face of Boer statesman Paul Druger while the reverse showcases the national symbol of South Africa, the Springbok.

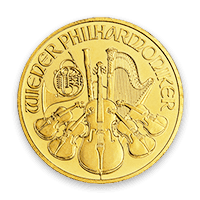

Gold Vienna Philharmonics

The Philharmonic, minted by the Austrian Mint, is named after the famed Vienna Philharmonic orchestra. First introduced in 1989, the coins sides depict traditional orchestra instruments. The Philharmonic is one of the worlds best selling gold bullion coins and is currently the only European Bullion coin with a face value in Euros, although it is only legal tender in Austria.

Bullion coins and premium coins are internationally recognized, liquid and provide gold investors with many options to choose from. It boils down to personal preference and investment goals when purchasing.