Why it’s never too early or too late to start an IRA

Today. Today is a great day to plan for the rest of your life.

Retirement is a phase of life often dismissed until later years, but one that demands strategic planning and proactive measures regardless of age.

Whether you’re fresh out of college or approaching the twilight of your career, establishing an Individual Retirement Account (IRA) can pave the way for a financially secure future. Let’s explore the compelling reasons why it’s never too early or too late to embark on the journey of retirement planning by opening an IRA.

1. Harnessing the Power of Compounding

The key to maximizing your retirement funds lies in the magic of compounding. By starting an IRA early, you tap into the immense potential of your investments to grow exponentially over time. Even small contributions can lead to substantial gains due to the compounding effect, making early investment a prudent move.

2. Building Financial Discipline

Opening an IRA at a young age fosters financial discipline and responsible money management. This early engagement with your financial future can set a precedent for healthy financial habits, helping you avoid debt traps and ensuring that your retirement is characterized by financial freedom.

3. Taking Advantage of Tax Benefits

IRAs offer distinct tax advantages, making them an essential tool for retirement planning. Contributions to traditional IRAs are often tax-deductible, reducing your taxable income for the year. Roth IRAs, on the other hand, offer tax-free withdrawals in retirement. By starting early, you can capitalize on these tax benefits to optimize your retirement savings.

4. Adapting to Changing Life Stages

Even if you’re closer to retirement age, it’s not too late to open an IRA. Life’s journey is full of unexpected twists, and your financial needs evolve accordingly. By beginning an IRA later in life, you’re acknowledging the importance of preparing for retirement and taking proactive steps to ensure your golden years are secure.

5. Expanding Your Investment Horizons

An IRA provides a versatile platform for investment. Regardless of your age, you have the opportunity to diversify your portfolio and explore various asset classes, such as stocks, bonds, and mutual funds. This diversification mitigates risk and enhances your potential for long-term growth.

6. Combatting the Rising Cost of Living

Retirement brings with it the challenge of maintaining your desired lifestyle without a steady paycheck. The sooner you start an IRA, the more you can accumulate to counteract the impact of inflation and the increasing cost of living during your retirement years.

7. Leaving a Legacy

An IRA doesn’t just benefit you; it can also serve as a legacy for your loved ones. By designating beneficiaries, you ensure that your hard-earned assets pass on seamlessly to your heirs. Starting an IRA at any stage of life signifies your commitment to safeguarding your family’s financial future.

There is no better time than today.

In the realm of retirement planning, the adage “better late than never” holds true. Whether you’re a recent graduate or a seasoned professional, the time to start planning for your retirement is now. Opening an IRA not only builds a secure financial foundation but also empowers you to embrace the future with confidence and peace of mind. The journey towards a fulfilling retirement begins with a single step - the decision to start an IRA, regardless of your age.

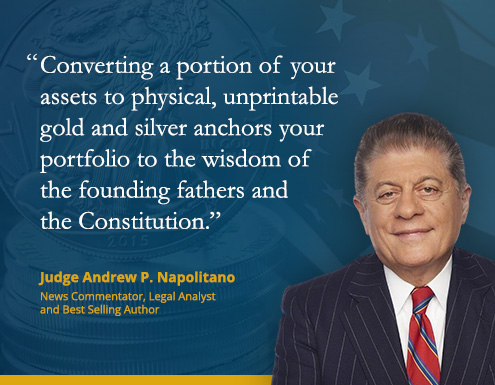

Want to harness the power of precious metals for your retirement? We specialize in precious metals backed IRAs – and we can rollover an existing IRA into precious metals, too!