Business Insider: 4 Indicators Have Lined Up for What Could Be 'The Biggest Loss of Perceived Value from Assets That we Have Ever Seen'

Article by Vicky Ge Huang in Business Insider

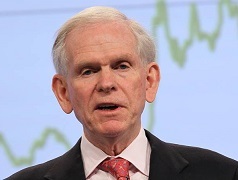

When Jeremy Grantham declared in January that "the long, long bull market since 2009 has finally matured into a fully fledged epic bubble," he said he knew there would be "a substantial increase in crazy behavior" before it all came crashing down.

When Jeremy Grantham declared in January that "the long, long bull market since 2009 has finally matured into a fully fledged epic bubble," he said he knew there would be "a substantial increase in crazy behavior" before it all came crashing down.

The cofounder of Boston's Grantham, Mayo, van Otterloo & Co. is famous for having made prescient calls about the bursting of the 1989 Japanese asset-price bubble, the 2000 tech bubble, and the 2008 real-estate bubble.

"The thing about a bubble is if you can find more money and more crazy investors, it can keep going," he told Insider.

As it played out, what Grantham saw in the fourth quarter as "extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior" escalated into even more remarkable events in the first quarter of this year.

From the epic short squeeze in GameStop to the stratospheric rally of Dogecoin, the latest bout of market euphoria has even taken the spotlight away from special-purpose acquisition companies, which have raised $101.5 billion this year and secured $83.4 billion last year — more than the previous seven years combined.

'This is eerily like 2000'

To Grantham, the tales of frenzy and mania today are eerily reminiscent of the tech bubble, but signs of cracks are already appearing.

"So this is eerily like 2000,"he said. "It doesn't mean it might end tomorrow or just be a blip." In his view, the bursting of bubbles comes slowly and then all at once.

4 indicators have lined up

This time, the combination of the massive fiscal-stimulus program and the effective rollout of vaccinations is likely to push the bubble to last longer, according to Grantham.

But he doesn't think it will change the outcome where asset prices revert to a more reasonable level and investors enter a more pessimistic phase. "What it means is the higher you go, the bigger the fall," he said.

Another thing to consider in a bubbly environment is the ......

To read this article in Business Insider in its entirety, click here.