Seeking Alpha - Gold: History is Repeating Itself - Time to Listen to the Buy Bell

Article by Brian Fletcher in Seeking Alpha

In 1968 gold was at $35.18 per ounce, when it commenced its secular bull market before it topped at $185.50 in December, 1974. During the following 2-years, it retraced in a cyclical correction to $104 – see the chart below “Gold 1968 to 1980…). Less than 4 short years later, it rapidly climbed 6.5 times in value to $675.

Gold 1968 to 1980

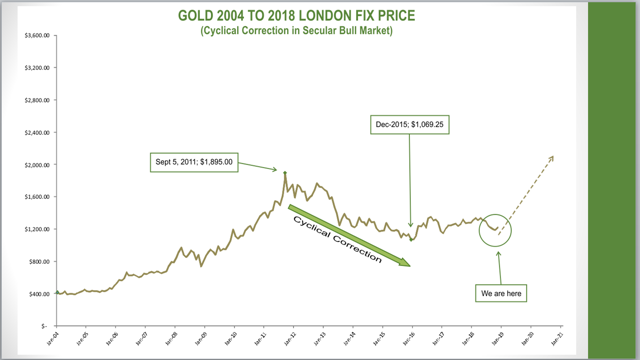

Now, come forward to January 2004, gold was at $416, approximately 10x where it was in 1968. It then commenced an uptrend into the $1,900 region in September, 2011, or approximately 10x the level it topped in 1974. During the following 4 years, through December, 2015, gold formed a cyclical low at $1,069, or approximately 10x where it bottomed in 1976.

Gold 2004 to 2018

What does this mean? One thing is for sure, the sentiment for metals is as negative today as it was in 1976, right before an enormous move up.

Metals are extremely emotional, and when they do make their move, most investors are left at the depot wondering why or how they missed the ride. As they gather steam, finally investors climb aboard, later in the cycle, and drive prices higher.

We see two distinct and highly likely potentials – 1. Gold moves up to the $1,600 - $1,700 region before then turning down to make another low below that it made in 2015; or 2. In the next move up it takes out the 2015 high in a massively bullish posture.

From a pure investment or trading perspective, at this time it really makes no difference which, as the move up is either bullish, or VERY bullish. The HUI Goldbugs Index is in the final squiggles of its 2-year correction against the move up in 2016. Even if only the bullish setup is at hand, the next move up will increase 3-5x in the index. The VERY bullish scenario would be much higher.

The move up in gold that occurred in 1976 left most market participants behind, and unfortunately much in the same way the next move up will do the same.

Don’t be part of the crowd that fails to participate in the next move up, which unfortunately will include most market participants.

As Mr. Buffet would say – “you pay a very high price in the stock market for a Cheery Consensus”. The signs we’re seeing today are as close as it gets to the market ringing the proverbial bell that says go buy.

To read this article in its entirety in Seeking Alpha, click here.