What they don't tell you in the jobs Report

Jobs & Modern Day Food Lines

The latest jobs numbers were lauded as very positive. The economy added 223,000 jobs. The official unemployment rate is down to 3.8% - a number that is considered full employment! The headlines have overwhelmingly been sunshine and optimism…

Look a little bit deeper in the numbers, however, and you find that labor force participation sits at a measly 62.9%. How do we come up with full employment if 37.1% of workers are not working? The answer is all in how you calculate the statistics. If you define the hopelessly unemployed out of the equation, even if they really would like a job, you end up with a better number, obviously. Never mind the truth.

We have to deduce that you exist by subtracting unemployment from labor force participation. But on the surface, the numbers look better, and that is supposed to make us all feel better and have great soundbytes for the news.

Today’s statisticians at the Bureau of Labor and Statistics simply do not see you if you’re not working and you’ve given up looking for work. The opioid crisis in the Midwest seems to be exacerbating this invisible gap between official unemployed and the not participating, as the areas with the largest opioid prescription rates also have the lowest labor force participation rates. Also students are staying in school longer as the entry level job horizon doesn’t seem enticing enough to get started on those student loan payments. More and more baby boomers reach retirement age every day.

Those are just a few factors that combine to give you “full employment” but only 2.2% GDP growth. For comparison, the last time we had unemployment at this level, in 2000 the economy grew at a robust 4.1%.

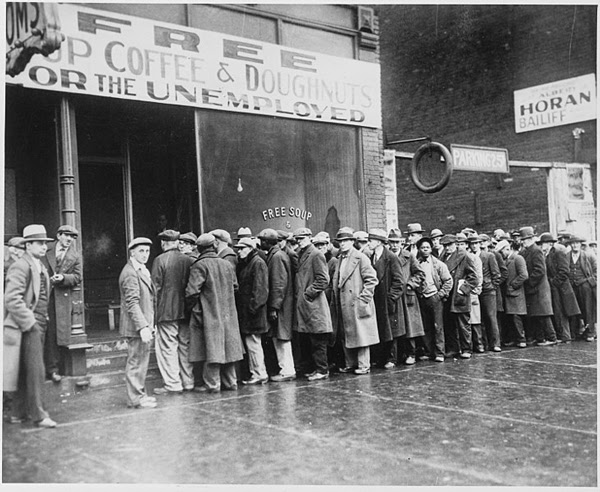

What We Don’t See

In the Great Depression you COULDN’T ignore the destitute. The lines for the soup kitchens and bread lines were right in front of you, stretching around the block. They were famously photographed as a symbol of our economic calamity. Now, of course, people on food assistance get benefit or EBT cards that they use at the grocery store just like a credit card. You would have to be looking directly over their shoulder to notice that they are actually in the breadline, 21st century style. And yet, as of February 2018 40 million Americans participate in SNAP (Supplemental Nutrition Assistance Program) or food stamps. That is almost 15,000 people for every Walmart Super Center in the country. That is a heckuva breadline, but it is invisible.

The other glaring problem with these jobs the economy is adding is that they aren’t nearly as good as the jobs we lost during the housing crisis. They pay less, they require fewer hours, the benefits are not as good or non-existent. They are not in the really critical area of manufacturing. These are not jobs that make things, or that create enduring value, these are not jobs that anchor the economy. These are weaker jobs.

The economy may be in a weaker position than what is reported.

And yet, many Americans’ investments and retirement funds are 100% wrapped up in this market which may prove to be dangerous. Major asset managers like Bridgewater are beginning to turn bearish:

“In one of Bridgewater's latest Daily Observations authored by co-CIO Greg Jensen, the firm writes that "2019 is setting up to be a dangerous year, as the fiscal stimulus rolls off while the impact of the Fed's tightening will be peaking" a point echoed yesterday by the head of the Indian central bank, Urjit Patel, who warned that unless the Fed ends its balance sheet reduction which comes as a time when the Treasury is soaking up dollar liquidity by issuing substantial amounts of Treasuries to fund the Trump budget, the tightening in financial conditions could lead to a global conflagration started by emerging markets.”

When an outperformer like Bridgewater “de-risks” its US equities holdings from 120% to just 10% and begins to short, you might want to pay attention and take some actions. What actions? A critical part of a well-balanced portfolio is invested in “contra-assets” or assets that do well when the market is struggling.

The best time to buy these contra-assets are of course when the market does not appear to be struggling much, to the casual observer. Gold and silver historically are the standard bearers of the contra-asset class. When the market sinks, many flock to hard assets that can’t simply be printed as a safe haven, and that makes the price go up, opposite the market.

If you had $50,000 in 2000 and invested 100% of it in the DOW, you would have around $79,000 today, which barely keeps up with inflation. If you had invested 20% of that in precious metals, however, you would have $103,000. Clearly, precious metals should be part of a well-diversified portfolio in these times.