Only 3 Times in History Has the Stock Market Been This Overvalued

Are we back in bubble territory?

You be the judge, but let us present some evidence that we consider highly concerning.

The S&P is trading at around 2390 these days - a record-high level in the history of the index. How long do you think the S&P can continue to trade at all-time highs?

Of course, prices are one thing. Higher prices can signal that healthy growth and productivity is driving demand. When that is the case, you see justification for prices in the strong valuation of the underlying assets. You see strong earnings.

When that is NOT the case, you see… something else.

Unfortunately, in this era of low interest rates, it is basically impossible to make a decent rate of return from interest on capital. Portfolio managers are increasingly forced into riskier and riskier investments to find the returns their clients are expecting. Faced with enormous pressures and heavy competition on Wall Street, are they making irrational decisions because they are simply backed into a corner?

If that were the case, what do you suppose underlying price-to-earnings ratios (P/Es) would show?

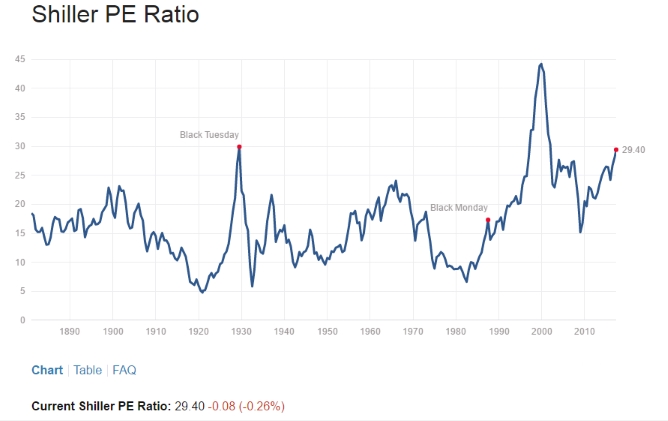

Here’s a hint: The only time the S&P 500 was this expensive relative to earnings, was right before three notorious crashes.

- In 1929 at the peak of the roaring 20’s, just months before the Great Depression

- In the dot-com bubble between 1996 and 2002, before declining almost 50% in the subsequent bear market

- In 2007 a the peak of credit bubble, just before a massive 55% decline as the credit crunch exploded

This is according to the Cyclically Adjusted Price/Earnings (CAPE) ratio as formulated by Robert Shiller. Normal P/E stands at around 24, but the more detailed, in-depth Shiller CAPE puts it at an astonishing 29.4! To give an idea, over the last century, the market averages out at around a 16.9 CAPE with a range between 5 and 44. At 29.4, we are 60% higher than average, which is overvalued.

This clearly indicates that the higher prices overall in S&P stocks are not justified based on earnings or productivity. Instead, we are seeing the irrational exuberance of investors and portfolio managers seeking a return simply by jumping on a bandwagon.

Folks, we know where this kind of money management leads. We've seen it time and time again. Clearly, many are refusing to learn from past mistakes and are just asking to be burned by the next crash.

We appear to be teed-up for a correction in stock prices!