Investment Coins vs. Bullion

A Checklist of Differences

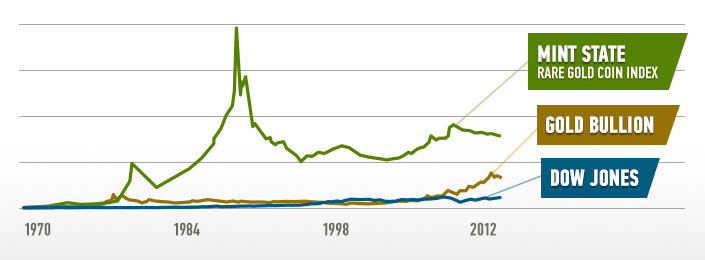

1. Profitability

While gold bullion has had an impressive record of profitability since the mid-70's, there really is no comparison with investment rare coins. A $1000 basket of gold mint state rare premium coins — from 1970 to today — is now worth a stunning $105,995.99. (Based on the CU Guide at PCGS.com)

2. Privacy

With some forms of gold bullion, a 1099 form must be completed. Not so in the case of rare investment coins where there are no reporting requirements whatsoever whether you buy or sell. You'll enjoy a degree of privacy simply unsurpassed by any other investment.

The statements made on this Website are opinions only. Past results are no guarantee of future performance or returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same depending on a variety of factors. Lear Capital, LLC cannot guarantee, and makes no representation, that any metals purchased will appreciate at all or appreciate sufficiently to make customers a profit. Lear is a retail seller of precious metals and its buyback (or bid) prices are lower than its sell (or ask) prices. Metals must appreciate enough to account for this difference in order for customer to make a profit when liquidating the metals. Lear does not provide financial advice or retirement planning services. The decision to purchase or sell precious metals, and which precious metals to purchase or sell, are the customer’s decision alone, and purchases and sales should be made subject to the customer’s own research, prudence and judgment.